Blog

The Complexity of Behaviour Change

Press

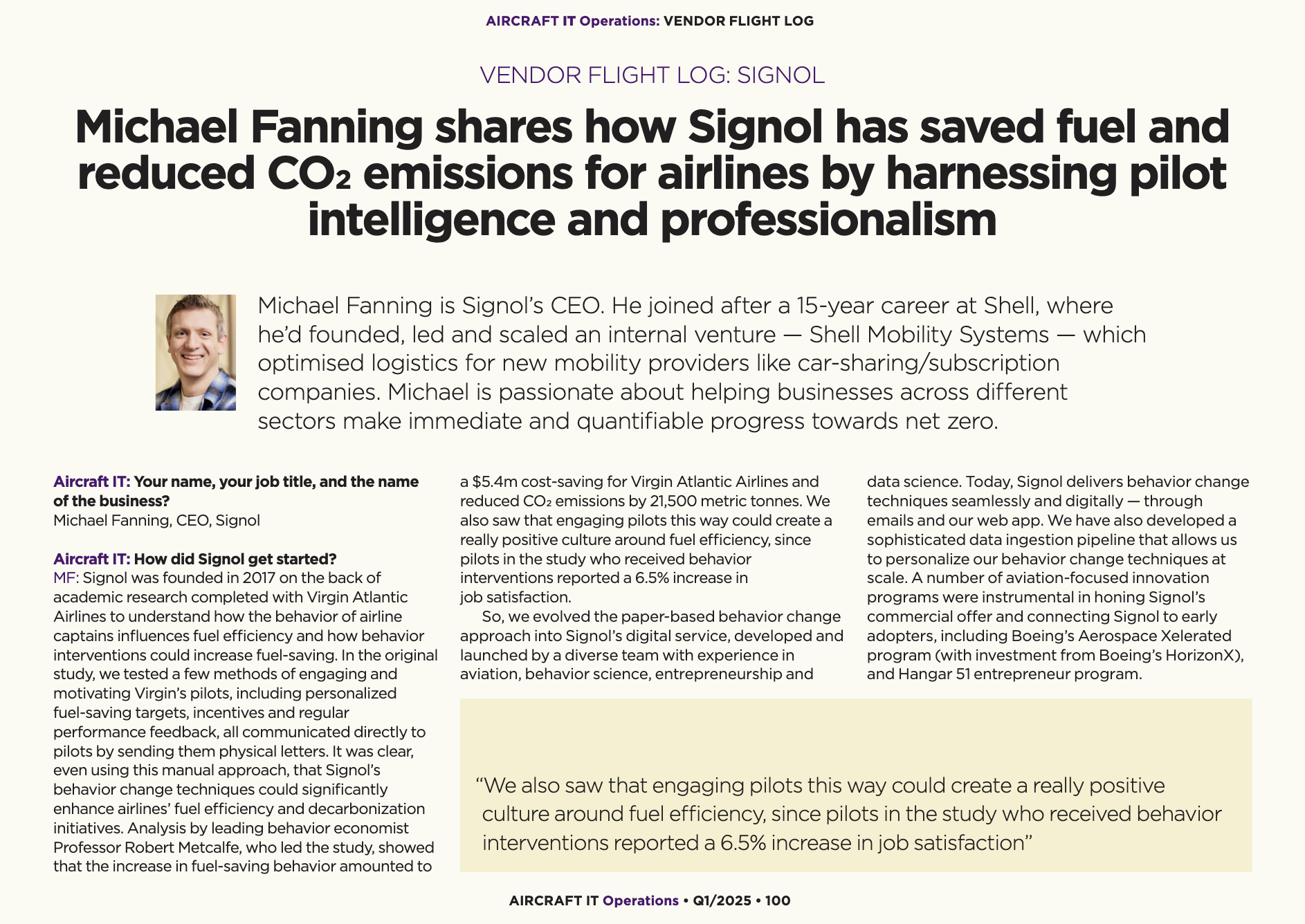

Aircraft IT Ops: Vendor Flight Log - An interview with Michael Fanning (CEO)

Blog

Changing the behaviour of highly trained and experienced professionals in aviation and maritime

Blog

What influences whether airline pilots and seafarers save fuel?

News

Every action counts: Ultranav starts trial with behaviour change service Signol to minimise CO2 emissions

Blog

Human behaviour: the overlooked factor in improving operational efficiency

News

Christiania Shipping reduces fuel bill and CO2 emissions in months using behavioural science

Press

Save fuel or have a coffee? Why motivated seafarers can help cut shipping emissions

News

Signol’s six-month trial with Cargill shows significant opportunity for fuel-saving

News

Sustainability startup Signol raises £2.5m to harness the human factor in emissions-intensive industries

News

Signol to showcase Virgin Atlantic success at Miami aviation conference

Case Study

Signol's pilot-first behavioural science solution saved Virgin Atlantic 39.5k of CO2 emissions in 18 months

Featured in